- #See finance 2 vs banktivity how to

- #See finance 2 vs banktivity update

- #See finance 2 vs banktivity download

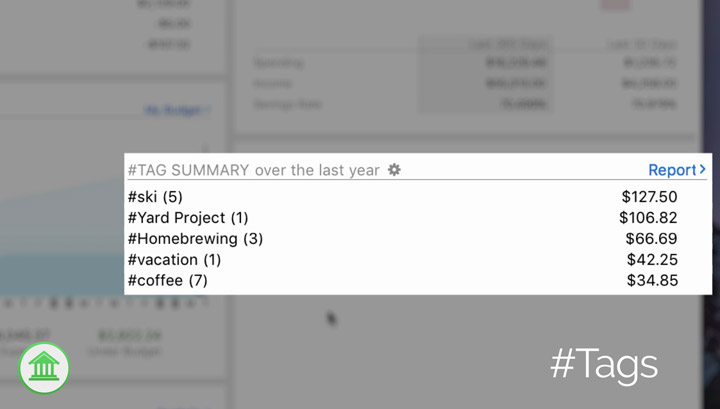

Assign tax codes to transactions to generate Tax reports (or export to TurboTax). You can even pick which lots you've sold from.īuilt-in report templates (Income & Expense, Net Worth, Payee Summary and more) dynamically analyze your finances. Banktivity calculates IRR, ROI and gains and losses. You can track buys, sells, splits, dividends, options and more. Actual reports.īanktivity's investment features manage stocks, bonds, mutual funds, IRAs, 401Ks, CDs and other assets. You’ll always know how well you’re tracking to your budget and savings with Banktivity’s visually-driven Budget vs. And any money not spent can be carried carry over into your savings.īanktivity automatically budgets scheduled transactions like paychecks and bills (categorized to your Envelope Budget). By giving yourself available cash for specific purposes, Envelope Budgeting lets you assign money to different categories. Sync devices, fetch Direct Access data, security prices even currency exchange rates.īanktivity's budgeting tools help you to set saving and proactive spending goals.

#See finance 2 vs banktivity update

It’s simple to update your accounts all at once with Banktivity's "Update Everything" button. (Including online bill pay!) Do it all yourself or let Banktivity’s transaction templates do the work for you. You’ll easily track, categorize, tag, reconcile and manage every transaction.

#See finance 2 vs banktivity download

Banktivity's Direct Access service makes this even easier by connecting to over 14,000 banks worldwide, automatically delivering the latest transaction data to your Mac.īanktivity's set-up assistant will import your old data and download current transactions from your bank accounts online.īanktivity gives you a holistic view of your finances - checking accounts, savings, credit cards, real estate, mortgages, investments and budgets. The first step in better money management is getting all your finances and accounts into one place. You’ll have immediate access to the tools, resources and U.S.-based support to make smarter financial decisions.

The key to reaching all your financial goals comes down to one simple idea:īanktivity gives you everything you need to do just that and more! And all in a user-friendly environment that’s safe and secure. I hope this helps.Make the Most of Your Money with Banktivity I love my Mac, but they're starting to price me out, man.

Much of the reason I've been trying to switch. And seriously, other than Banktivity, I had no good reason. The last time I bought a computer, I really had to think about why I'm buying a Mac.

#See finance 2 vs banktivity how to

If you can figure out how to make YNAB work for you (and they have tons of FAQs and videos), the other bonus is you can buy a much cheaper computer next time, too. For whatever reason, none of this made sense to me with a weekly paycheck. And it works on the envelope method that makes it easy to move money in between categories. I can set strict budgets on each category every month and I have to stick to them because, boom, I only get paid once. Now that I'm paid monthly and I don't always have my income constantly changing, I find YNAB is much better. Banktivity just made it easier to track spending and see where I could cut costs. When I was getting paid every week I just had no ability to create a weekly budget, and with YNAB I couldn't wrap my head around how to do that. I can see where my money is going but I can't limit it.

So my opinion is this: I suck at budgeting but I'm great at tracking. Recently I've started to get paid monthly which has made it a whole lot easier to do a monthly budget. I've actually been trying to switch to YNAB for a few years and I've never really been able to wrap my head around it, mostly because of the way I've been getting paid.

0 kommentar(er)

0 kommentar(er)